Introduction:

Bitcoin, the first decentralized cryptocurrency, has transformed the way we think about money. Launched in 2009 by an anonymous figure known as Satoshi Nakamoto, Bitcoin has grown into a global phenomenon. With its unique features and underlying technology—blockchain—Bitcoin has reshaped the financial landscape and sparked the creation of thousands of other cryptocurrencies. In this post, we’ll dive into a detailed review of Bitcoin and its impact on the world.

What is Bitcoin?

Bitcoin is a digital currency, also known as a cryptocurrency, that operates on a peer-to-peer network. Unlike traditional currencies, Bitcoin isn’t issued or controlled by any government or central bank. Instead, it’s managed through a decentralized network of computers that validate transactions via blockchain technology.

How Does Bitcoin Work?

Bitcoin transactions are secured and verified through cryptography. When someone sends Bitcoin to another user, the transaction is recorded in a public ledger known as the **blockchain**. The blockchain is decentralized, meaning it is not controlled by any one entity, ensuring transparency and security. Transactions are verified by miners, who use computational power to solve complex mathematical puzzles. In return for their efforts, miners are rewarded with newly minted Bitcoins.

Advantages of Bitcoin:

Decentralization: Bitcoin operates without a central authority, making it immune to government interference.

Security: The use of blockchain and cryptography makes Bitcoin transactions highly secure.

Limited Supply: Bitcoin has a fixed supply of 21 million coins, making it immune to inflation.

Global Transactions: Bitcoin allows for fast and low-cost international transactions without the need for intermediaries like banks.

Challenges of Bitcoin:

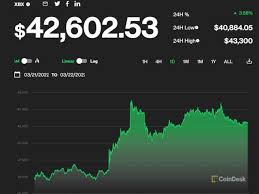

**Price Volatility:** Bitcoin’s value can fluctuate dramatically, making it risky for investors.

**Regulatory Uncertainty:** Governments around the world are still figuring out how to regulate cryptocurrencies.

**Scalability Issues:** Bitcoin’s transaction speed and network capacity are limited, causing delays and higher fees during periods of high demand.

Bitcoin’s Impact on the Financial World:

Bitcoin has paved the way for decentralized finance (DeFi) and has inspired the creation of many other cryptocurrencies. It challenges traditional financial systems by offering an alternative to centralized banking. Bitcoin is also being adopted by businesses for payments, and some even consider it a “store of value” akin to gold.

Conclusion:

Bitcoin is a revolutionary financial asset with the potential to disrupt traditional systems. While it offers many benefits, such as decentralization and security, it also faces challenges like volatility and scalability issues. As Bitcoin continues to evolve, its influence on global finance will only grow, with its impact already being felt worldwide.